71

AirAsia X Berhad • Annual Report 2014

aircraft earn positive income but this will also be in US

Dollars, providing us with better currency mix as a natural

hedge against adverse foreign exchange movements.

Our market leadership in the routes we have established

is such that even with the frequency trimming, we are still

capturing more than 50% of all the core routes that we

currently service.

In addition to the redeployment of aircraft, we have begun

to consolidate our routes, terminating those that are

under-performing while adding capacity to more profitable

sectors. We have, for example, increased the frequency of

flights to Seoul (Incheon), South Korea from 7 times a week

to 11 times weekly beginning in January and 14 times

weekly during peak season; while that from Kuala Lumpur

to Kathmandu, Nepal was enhanced from 7 to 10 times

weekly during the peak holiday period from 26 October

until 31 December 2014.

The process is ongoing and saw us reinforce our

connections with China, targeting in particular currently

underserved destinations where demand is high. During

the year, AirAsia X introduced flights to Xi’an, in the

north-west, and added Chongqing in the south-west to its

route network in 2015. These represent our fifth and sixth

destinations in China, after Hangzhou, Chengdu, Beijing

and Shanghai.

Further developing connections with North Asia, we

launched a new route from Kuala Lumpur to Narita, Tokyo

in November which continues to be popular, justifying our

serving a second airport in the capital city, after launching

flights to Haneda in December 2010.

ANCILLARY BUSINESS

Various initiatives were launched to further grow AirAsia

X’s ancillary business, which not only enhances our

revenue but also adds to guests’ comfort, convenience and

sheer pleasure when they fly with us.

In June 2014, AirAsia X launched 46 new Fly-Thru

connections from Australia, China, Japan, Nepal, Saudi

Arabia, South Korea, Sri Lanka and Taiwan to various

destinations in Malaysia, Indonesia, Cambodia, Thailand,

Vietnam, India, Brunei and Macau. These effectively

enable guests to connect from one sector of their travel to

another without having to re-check in either themselves or

their baggage.

We also extended our menu on board to include DeluXe

Meals which include appetizers, desserts and juices, such

as the Big Breakfast, Roasted Chicken with Stuffing and

Cranberry Sauce and, our latest meal addition, Onigiri

(Japanese rice balls) with Chicken Karaage (fried chicken).

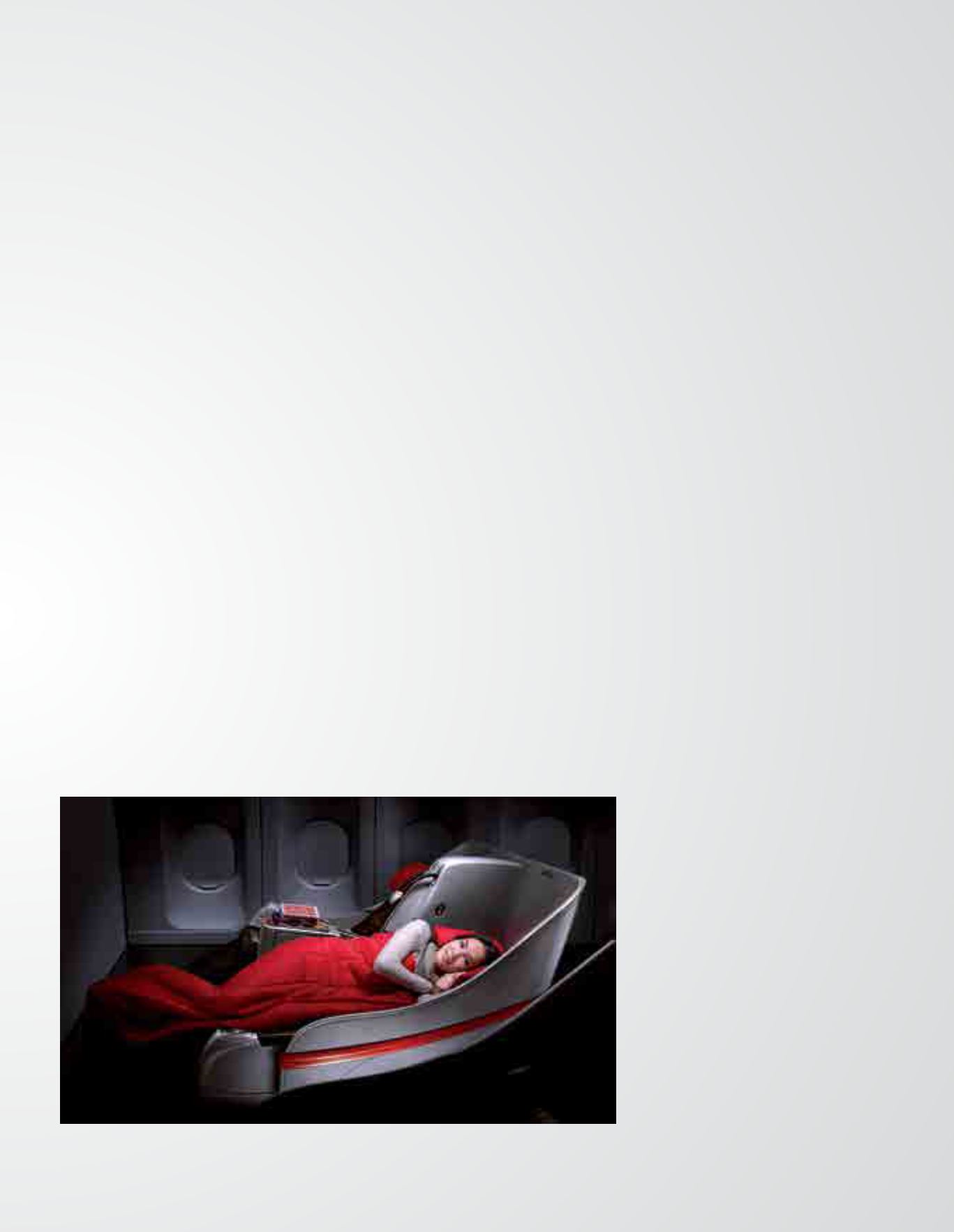

Meanwhile AirAsia X’s Premium Class, which has been

re-branded as Business Class, continues to be a fast

favourite, and led to AirAsia X being awarded the World’s

Best Low-Cost Airline - Premium Class Seats and World’s

Best Low-Cost Airline - Premium Cabin by Skytrax for the

second consecutive year. That this innovation is valued

specifically by our guests is evidenced by the numbers.

Despite the A330-300 configuration of 365 Economy Class

seats versus 12 Business Class seats, revenue generated

by Business Class during the year was three times more

than that of Economy Class

DISTRIBUTION CHANNELS

AirAsia X has much to offer the citizens of Asean and

beyond, the majority of whom continue to be underserved

by LCCs and particularly by LHLCCs However, being still

relatively young, and catering to a large number of non-

Malaysian travellers – 70% at the last count – there is still

a need for us to create greater visibility and awareness

of our brand. This we are beginning to do by developing

alternative distribution channels as we collaborate

more closely with online travel agents (OTAs) and global

distribution systems (GDSs).

PROSPECTS

Over the last two years, along with increased capacity, we

introduced a number of new routes which typically take

12 months to mature. Given the unusually challenging

environment in 2014, the normal gestation period for some

of these routes has been prolonged. Our strategy for the

year 2015, therefore, is to let market forces take their

course, and to allow our routes sufficient time to start

yielding profits. We are, in fact, rationalising our route

frequencies and channelling excess capacity towards wet

lease partnerships entered into during the year. This way,

we believe, we should see our capacity growth in Malaysia

drop to no more than 5% year-on-year, which is both

rational and manageable in current circumstances.

Going by simple forces of supply and demand, reduced

capacity in the industry will drive up the yield of average

base fares. As the year 2015 has begun to unfold, along

with a natural pick-up in the travel sector, signs of this are

already evident. As this trend continues, we expect our

average base fare to improve in 2015 as compared to 2014.

Meanwhile, many plans are in the pipeline to grow our

revenue from ancillary services. We already have a number

of innovative products and services waiting in the wings,

such as WiFi on board, a Duty Free mall in the sky offering

the latest labels and cutting-edge technology products, an

extended menu with attractively packaged Asean meals,

children’s meals with toys on the side, fresh coffee brewed

and served by baristas… all of which can be more easily

purchased by guests using a specially designed AirAsia

EZPay Passport, a pre-paid credit card which will be able

to accommodate up to seven different currencies – the

Ringgit, US Dollar, Euro, British Pound, Australian Dollar,

Singapore Dollar and Yen.

Over and above these hard-to-resist products, there is still

huge potential to develop the Fly-Thru facility, especially to

connect flights arriving in and departing from the different

AirAsia X Group airlines bases – namely Kuala Lumpur,

Bangkok and Bali.

ACTING CEO’S STATEMENT